Since Facebook filed papers this weekstating its plans to go public, a wealth of information about Mark Zuckerberg and the company he founded in a Harvard dorm room has been made public.

Here's a rundown of the most recent dish.

Taxes

Zuckerberg plans to exercise an estimated $5 billion worth of stock options ahead of Facebook's IPO. According to The New York Times, that could create a tax bill of $2 billion, which is probably one of the highest ever for an individual.

In comparison, government data shows the 400 wealthiest filers paid an average of $48 million in federal income taxes in 2009. To put it into further perspective, billionaire Warren Buffett paid less than $7 million in taxes in 2010.

Political Insiders

Facebook is getting cozier than ever with Washington. That's according to The Washington Post, which has laid out the extent to which the social network has put political veterans in key executive roles and board positions as well as created a powerful lobbying operation.

Recent hires include Marne Levine, who was chief of staff to President Barack Obama's former chief economic adviser and appointed as head of global public policy; Theodore Ullyot, who was deputy assistant to former President George W. Bush and appointed as general counsel; and Joe Lockhart, who was former President Bill Clinton's press secretary and appointed as Facebook's vice president of communications.

Facebook COO Sheryl Sandberg is also a political veteran and was chief of staff for Larry Summers when he served as Treasury secretary in the Clinton administration. The company's Washington office has also grown to an estimated 22 registered lobbyists and policy experts and recently hired Chris Herndon, who was the senior Republican counsel to the Senate body that oversees the Internet industry.

Facebook will need its political heft because of investigations into privacy violations and varying international regulations that affect how the company operates outside of the United States.

Other Details

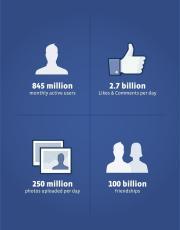

Mark ZuckerbergPCWorld's Ian Paul recently reported several other interesting Facebook facts that surfaced after it filed papers to go public. Raking in $1 billion in profit last year, the company will likely hit the one-billion-users mark in 2012. It also revealed that more than half of Facebook's monthly active users visit the social network from mobile devices, and about 80 percent of Facebook's fans are outside the U.S. and Canada.

And PCWorld editor David Daw has pointed out that if everything goes as planned, Facebook's IPO could create between 500 to 1000 new millionaires at the company, giving seven-figure payouts to nearly one-third of its workforce.

Facebook is expected to trade on the NYSE under the symbol FB, although there's no firm date when you can expect to buy stock in the company.

0 comments:

Post a Comment